regional income tax agency estimated payments

Starting on Monday April 25th the North entrance to the Cleveland office on W. Use this form to allocate existing paymentscredits between separate individual accounts.

![]()

Individuals Estimated Tax Payments Regional Income Tax Agency

Ifyou file on an extension and you expect to owe estimated taxes for 2020 remit your first quarter estimated payment with Form 32.

. -If you need tax forms or more information contact the central Ohio branch of RITA at 8667217482 or visit here. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate the. If you file on an extension your first 2020 estimated tax payment is still due April 15 2020.

Salary information comes from 53 data points collected directly from employees. 505 Tax Withholding and Estimated Tax. See News and Important Updates for the Latest.

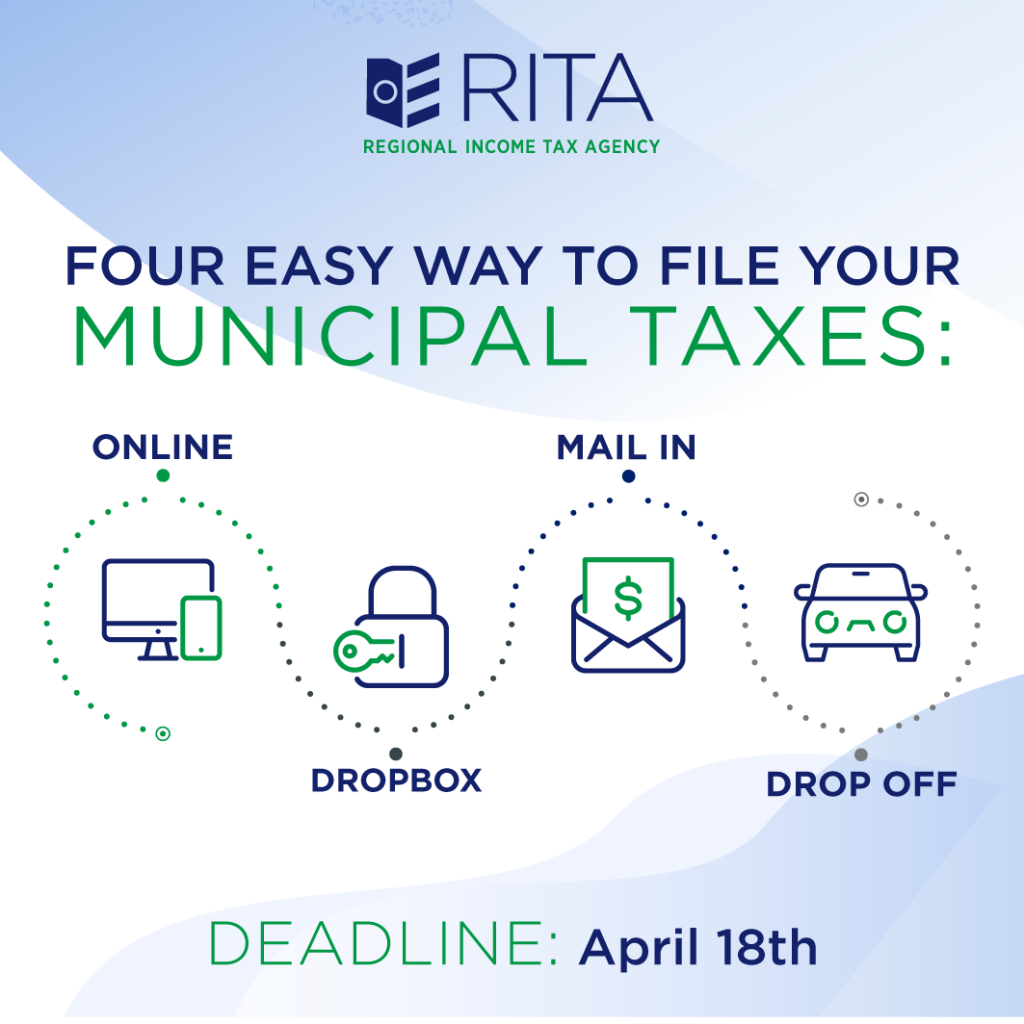

Municipal Income Tax Drop-Off Sheet. RITA offers the following payment options. Use the message center to send us a secure email.

Agency California Franchise Tax Board Certification date. Salary information comes from 53 data points collected directly from employees. Total Estimated Tax distribute to each applicable municipality in Line 5 00 Note.

The filing deadline to submit your 2021 municipal individual income tax return was Monday April 18 2022. Line 1 must equal Line 6 2Less Prior Year Credit 00 3. See News and Important Updates for the Latest.

Form 32 EST-EXT Estimated Income Tax andor Extension of Time to File. Regional Income Tax Agency Estimated Payments. Personal and Business Income Taxes Residents Non-residents State of California.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. Request for Allocation of Payments. CLEVELAND OH 44101-2004 BROADVIEW HEIGHTS 44147-7900.

Tax year ending _____ mail to. Estimated Payment not less than 14 of Line 3 00 Note. Extensions of time to file have no effect on the due dates of the 2020 estimated taxes.

See below for mailing address. Estimated Income Tax andor Extension of Time to File. Form 32 EST- EXT Estimated Income Tax andor Extension of Time to File.

REGIONAL INCOME TAX AGENCY REGIONAL INCOME TAX AGENCY. Broadview Heights OH 44147-7900. Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482.

Purpose of This Package Use this package to figure and pay your estimated tax. When figuring your estimated tax for the current year it may be helpful to use your income deductions and credits for the prior year as a starting point. Individuals - Online Services MyAccount - Regional Income Tax Agency.

RITA PO Box 477900 Cleveland OH 44147 - 7900. This line will NOT update your 2022 total estimated tax liability. Average Regional Income Tax Agency hourly pay ranges from approximately 1161 per hour for Data Entry Clerk to 2443 per hour for Paralegal.

To pay your tax balance due. Self-service phone options - making a payment checking refunds and estimates - available 247. Businesses - Payment Options - Regional Income Tax Agency.

If you are making an estimated payment enter the amount on Line 2. Self-service phone options - making a payment checking refunds and estimates - available 247. Brecksville Office - 10107 Brecksville Road Brecksville Ohio 44141.

Visa Master Card or Discover Card Please note that a 275 Service Charge will be added to payments made by credit card. Dual Agency Regional Center Foster Care a dual agency child is a child receiving AFDC-FC or AAP benefits who is served by a Department of Developmental Services DDS California Regional Center. 5 Regional Income Tax Agency Estimated Income Tax andor.

RITA PO Box 95422 Cleveland OH 44101 - 0033. Payments made by check or via ACH will not incur this service charge. Taxpayers will be directed to the buildings rear entrance.

Total Estimated Tax Due 00 4. Use your prior years federal tax return as a. If you need to report or update your 2022 Total Estimated Income Tax enter in Section 1.

Application for Municipal Income Tax Refund. Routine System Maintenance April 30th. Checking or Savings Account.

If you anticipate owing 200 or more in municipal income tax you must estimate your taxes and make quarterly payments as your income is earned. Dual Agency Regional Center Foster Care. Estimated tax is the method used to pay tax on income that.

Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Make check payable to RITA.

Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. As of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web. Regional Centers provide services to.

553 Highlights of 1998 Tax Changes. Postal Wage Amendment Statement Form. C Instructions for the 1998 Form 1040 or 1040A.

Extension of Time to File. -The city of Powell income tax is collected by the Regional Income Tax Agency RITA. Request for Allocation of Payments.

5 REGIONAL INCOME TAX AGENCY Net Profit Estimated Income Tax andor Extension of Time to File. If your estimated tax payments are not 90 of the tax due or not equal to or greater than your prior years total tax liability you may be subject to penalty and interest. -Estimated quarterly payments are required for individuals who have not had Powell taxes withheld from their income.

Kin-GAP payments are income to the child not to the caregiver. Use the message center to send us a secure email. You can pick up forms and instructions or obtain assistance completing your return Monday-Friday 8am to 5pm at any of the following locations.

Clair Avenue will be temporarily closed. REGIONAL INCOME TAX AGENCY. CLEVELAND OH 44101-4582.

RITA PO Box 477900 Broadview Heights OH 44147 - 7900. Form 10A Application for Municipal Income Tax Refund. The average Regional Income Tax Agency salary ranges from approximately 38257 per year for Auditor to 44037 per year for Compliance Auditor.

Routine System Maintenance April 30th.

State Of Oregon Oregon Department Of Revenue Payments

Rita Map Regional Income Tax Agency

Individuals Filing Due Dates Regional Income Tax Agency

The Lakefront City City Of Euclid

Dor Keep An Eye Out For Estimated Tax Payments

![]()

Individuals Estimated Tax Payments Regional Income Tax Agency

Income Tax Finance Director City Of Elyria

Finance And Income Tax Waterville Ohio

Income Tax City Of Gahanna Ohio

City Income Tax North Canton Oh

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

![]()

The Regional Council Of Governments Regional Income Tax Agency

![]()

The Regional Council Of Governments Regional Income Tax Agency